As the housing market cools… evidence is everywhere.

That’s right, signs of a real estate market shifting are all over the place. You see, after a few years of the rubber band stretching, and extremes in all data points I read… I’m seeing signs of when a housing market cools. The next step is the rubber band unleashing all that energy to return to its normal position. How? Why?

To explain, this essay is about the 4 I’s: Inventory, Interest Rates, Inflation, iBuyers/Investors. These four ideas have a lot to do with where our market is today… and where it’s heading.

Let’s start with the biggie, Inventory (Supply). This is the most important data point I watch as our housing market cools.

Over the last 24 months the number of properties available for sale in the US dropped about 68%, from around 2.3 million to just over 729,000.

In my local market of Delray Beach, I’ve been following inventory like a hawk and share this with my readers in my weekly eLetter (If you’d like to subscribe, shoot me a text or email).

2 years ago there were 54k properties available in S. Florida. It dried up and hit bottom 4 weeks ago at 14,781. Today, inventory broke above 15k for the first time since last November. Inventory now stands at 15,785.

As Florida is a retirement haven, a lot of the 55+ communities refrained from putting their homes on the market due to COVID. Well, as the pandemic is in its sunset phase, this group is allowing folks back into their homes, and… getting them ready to sell.

Like any good realtor, I watch the inventory levels each day and although reports are not out yet, we can see the number of daily new listings rising.

All this plays into pricing, too. Sellers who are asleep at the wheel, or who’s realtor is not sharing this data with them will have a hard time selling as inventory levels begin to rise. That’s more competition.

You can check out this essay from Florida Realtors. It shows you more evidence as this housing market cools.

Interest Rates

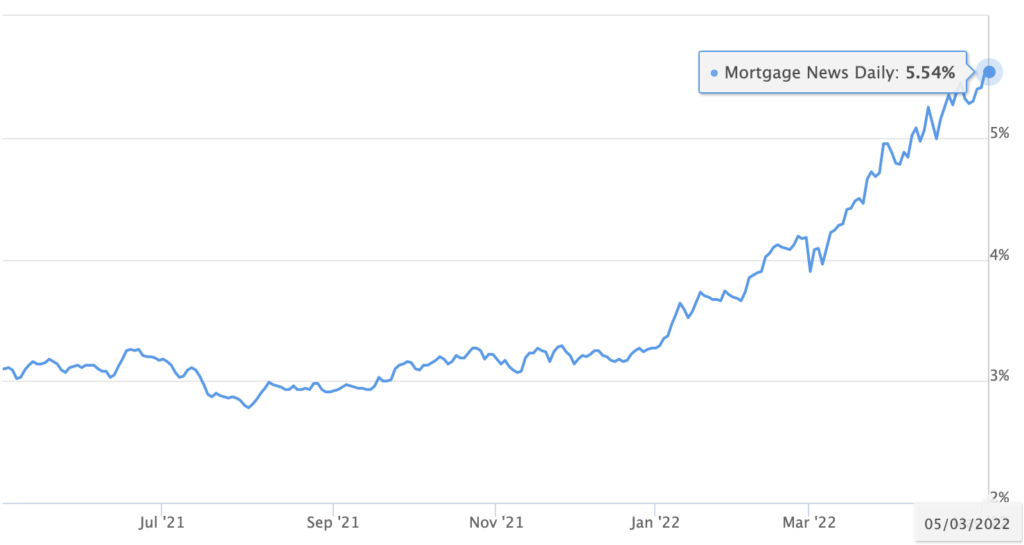

How often do you see rates rise over 25% in 30 days? Or 70% in the last year? These are extreme’s that will find their way back to normal levels. I’m not saying that interests will fall, but after a run-up like this, a cooling off period may be ahead as the news about rising Fed Rate Hikes gets “less bad.” And this run up in rates is one more reason why the housing market cools in 2022.

Look at this chart: 8 months ago, rates were 2.8%. Today rates are near 5.55%

What About iBuyer/Investors?

The first thing that sticks out to me are the performances of iBuyer stocks like Offerpad, Opendoor, and Zillow. These companies offer sellers a quick sale with cash.

It may not be a direct correlation, but it does offer an interesting part of the story:

- Zillow’s stock is down 76% from it’s peak

- Opendoor is down 67% from it’s highs

- Offerpad is down about 75% from it’s highs

Are these leading indicators of how investors will act over the next 6-9 months? With less market capital, these companies may find it hard to invest in properties that have reach their upper ends. And Zillow shut down its “Instant Buyer” program last November.

For further evidence as this housing market cool, look at these Wall Street real estate stock ticker symbols: RDFN, COMP, EXPI, RLGY. All of these stock prices are down more than 50%!

The Last “I” Is Inflation

In the last 20 years, inflation averaged between 2- 3.5%. Today it sits at 8.5%. Things like gas, food, cars, rent, real estate, energy are all UP.

Take a look at the summary and main points in this essay.

Bottom line, the average consumer is stretched to the gills. The rubber band cannot stretch any more without it snapping. Buyers are exhausted. Burnt out. Interest rates have buyers scared. And if you look closely at recent headlines – like in the last 21 days – the tone of media has already shifted.

Housing market cools is a real thing. I will keep an eagle-eye on it and share more with you as this unfolds.

But as I wrote to my eLetter readers last week, this may be the moment home buyers been waiting for! A New Dawn appears to have been awaken.

And I followed it up today with the video above “Housing Market Cools.” Have a look. I discuss all this and much more so that you get real data now.

To be one step ahead of the rest it’s important to dig into the data. As the housing market cools, you’ll see more evidence show up. Stick with me as my passion is bringing you the right information to guide you on the right path.

WELCOME TO MY CHANNEL! If you’re new, please subscribe: 👇👇👇👇👇👇👇👇👇👇 ✅ https://bit.ly/33u34fZ

Ready to start the conversation about moving to Delray Beach Florida? Call/Text me at 561-777-4089. I have folks contacting me weekly about living in the Delray Beach Florida area. I Love it! So if you’re thinking of moving or relocating to Delray Beach or South Florida, I can help you.

Click here my FREE Relocation Guide: https://mrdowntowndelray.com/relocation-guide-delray-beach/ Click here to get access to my FREE Investor Spreadsheet: https://mrdowntowndelray.com/investment-property-formulas/

🙋♂️Let’s be social: * Instagram: https://www.instagram.com/jmwieland * Facebook: https://www.facebook.com/RealtorProJo… * Twitter: https://twitter.com/JohnMWieland * LinkedIn: https://www.linkedin.com/in/john-m-wi…

🧑💻 Home Search: https://mrdowntowndelray.com/

Realtors – Partner with me at EXP Realty! Schedule a call to learn how. Florida license SL3444240. (Oh yeah, I lived in Costa Rica for over 12 years. Owned & operated 13 real estate franchise offices. If you’ve ever thought about buying a home in Costa Rica, call me. I can help you get from here to there safely and guide you through the entire process. My Costa Rica Rolodex is full of friends, lawyers, tour operator to help ).

#delraybeachrealtor #mrdowntowndelray #johnwieland