Dear landlords, have you adjusted your rents lately?

In my 25 years investing in real estate it ceases to amaze me how some landlords are stuck in a comfort zone. They don’t want to upset the applecart in fear of losing a tenant. And this can be a costly investment decision.

You see, owning investment property is valued differently than a home. There are Gross Rent Multipliers (GRM) or Cap Rates to consider (at least, this is how savvy cash investors play the game). So, if you’re not maximizing the rent on your property, you’re at a disadvantage when you go to sell it.

For example, if the going rent on your 2+1 units in your tri-plex is $1500, yet you’re only collecting $1200, this factors into the valuation of your asset. That $300 deficiency is a $3,600 annual shortfall on your Profit & Loss statement. And if the going GRM is 15, for example, then you’re losing $54,000 in upside value for just that unit. Multiple that by the number of units you have and… ouch!

Your mismanagement is the next buyers upside. And, cash investors are scouring the market for landlords who are asleep at the wheel.

How Much Is A Good Yield For Cash Investors?

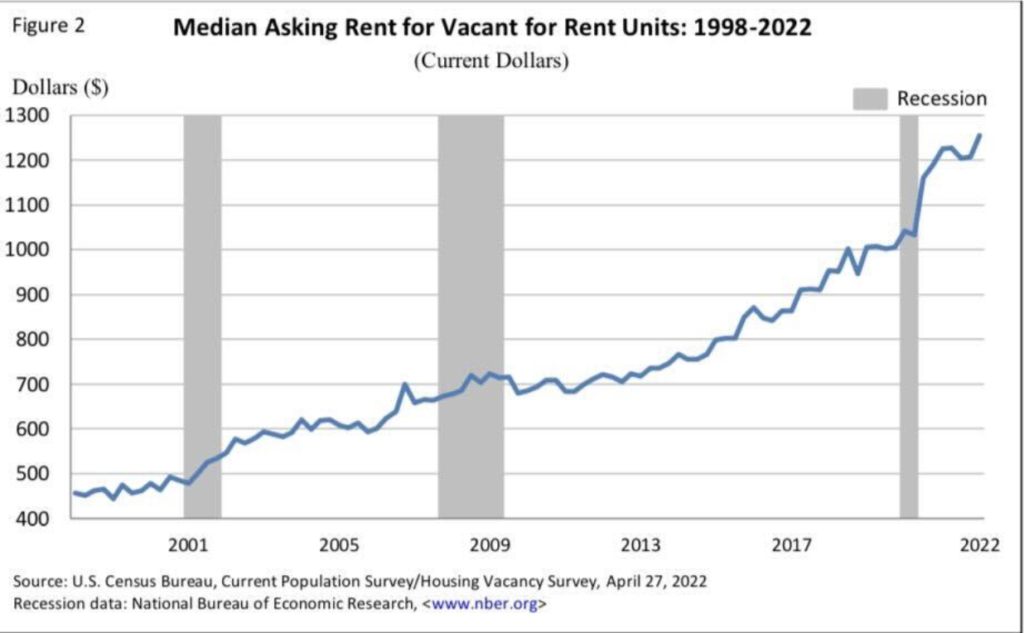

That’s where the chart below comes into play.

With rents rising the last 25 years, cash investors are gobbling up investment property. This includes homes and condos. Cash investors can’t get yields in the stock market like they can in real estate. Dividend yields in stocks is near an all-time low. So, they’re deploying their cash into properties that can deliver solid yields.

And I’m not talking about get rich, quick, yields. As banks pay less than 0.5% and stocks a thin 1-2.5% if lucky… cash investors are pleased when they can earn 5-8% on the capital per year.

Now, it’s not common for these cash investors to buy condos where non-deductible expenses like HOA fees dig into profits. To the contrary, they are seeking multiple-door scenarios. There is often a tri-plex or 20-plex out there that is mis-managed. It takes hunting and scouring marketing to find. But this is time well-spent.

(If you’d like to get your hands on an investment tool my partner and I created 25 years ago, clink here. I’ll provide it to you free – just provide your email so I can shoot it over to you).

So the whole story of cash investors today is they can buy an income producing property with cash, no mortgage, and generate cashflow now. Plus, they won’t worry about interest rate risk. They control the asset without any third party interference and make decisions in a snap.

If you’d like to jump into the real estate investment game and play the way cash investors do, you can start looking at properties that may fit the bill, here. You may need to build up a small portfolio for you can earn enough from them to buy your next property with cash. It takes time, so don’t wait.

And if you’re a landlord now, do an analysis on your rents and adjust them to today’s market. Don’t mis-manage your property. Why leave thousands of dollars on the table when it should be going in to your pocket? And why leave hundreds of thousand of dollars on the table when you go to sell?