Extremes are getting more extreme.

I call that real estate volatility. For context, let’s start with the two charts below.

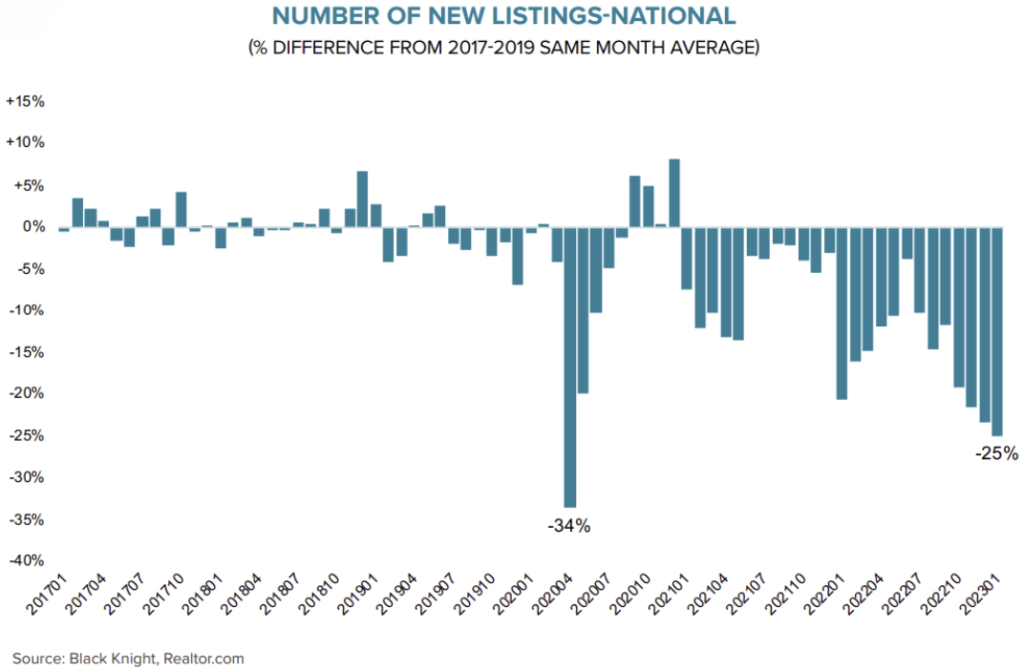

The first chart shows the change in new listings, in America, from 2017 to January 2023. As you can see, things were calm until mid-2020.

Since then, the average number of new properties put on the market is negative – meaning, below the stated average. But not just below – well below. Double digits.

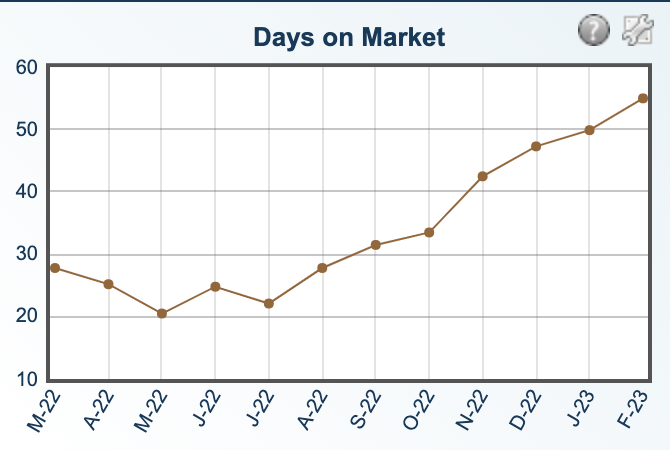

The second chart is my “famous” Days On Market (DOM). It’s been on my radar since it bottomed in July 2022. I’ve brought it up each of the last 7 months in my monthly report, “How’s The Delray Beach Real Estate Market.” Click that link to see February’s update just published this morning.

Since July, DOM is up 145%. In other words, it took 22 days to sell a home last July. Last month – February – it took 55 days.

These are extremes: double digits… triple digits. This is real estate volatility.

And there’s more:

* The 30-yr fixed mortgage is up 112% from one year ago…

* The percentage of cash buyers in Palm Beach County one year ago was 39%. Today it’s 56%. That’s an increase of 44%.

* The median Delray Beach residential sales price is up 19% from a year ago…

* Absorption Rate – how long the current inventory of properties would last at the current rate of sales – is up from 1.2 months to 3.65 months – an increase of 187%.

Real estate volatility is reaching its peak time. Can we point our fingers at the Covid pandemic? Were there other market forces that caused things to get out of whack? Sure, but what matters today is the ability for sellers to find buyers… and buyers to find sellers willing to sell at a price that’s obtainable.

It’s a rare event when mortgage rates double in less than twelve months.

Or when the Federal Reserve raised the Federal Funds Rate almost 5% in 2022. That’s unheard of economics. These drastic events to stave off worsening inflation are causing not just real estate volatility, but unchartered territory for wall street, venture capital and banks.

More importantly, your life is now in a state of flux. One year ago you made the decision to buy a home. Today that dream is toast. Think about it: a $700,000 loan at 7% costs $4,650 per month. At 4% it’d be $4,432. And at 3%, like many got just one year ago, cost $2,951.

Again – real estate volatility at extremes.

If you can’t stomach your home value changing so dramatically, or trying to time the market fearing you missed the precise moment to pull the trigger… stay away. Be patient.

This real estate volatility, too, shall pass.

———————————

*** Hampton Social Delray Grand Opening is TODAY! Get over there!

*** I got my GREEN Realtor Designation. Then I wrote this. I’ll be writing more on sustainable real estate ideas in this eLetter. If you’re interested in this topic, I’d enjoy hooking up to chat about these ideas and your thoughts.

*** Still a month away, but put the Billie Jean King Cup on your “fun activities” calendar. Local tennis star Coco Gauff will be playing!

———————————-

*** Your Weekly Real Estate Volatility Update ***

* 4 years ago there were over 54,000 properties available in S. Florida.

* It bottomed in February 2022 at 14,485… a 73% drop.

* Last week there were 30,134 available… a 115% rise in 12 months.

* This morning’s Inventory is 29.922.

*** Inventory is DOWN, 9 weeks in a row ***