Homeowners insurance prices in the Florida real estate market is rising faster than any state in the country.

My customer who’s buying a $1 million house just called me and said, “John, I got a $14,000 homeowners insurance quote on this house. What?”

Right now, insurance in Florida is a debacle. There has been a lot of insurance companies over the last five years that’ve left the state. They can’t make any profit here.

Hurricanes are getting stronger, fraudulent claims continue to go up. Everything is going in the wrong way… but there’s some light at the end of the tunnel.

Florida Real Estate Owners Pay The Piper

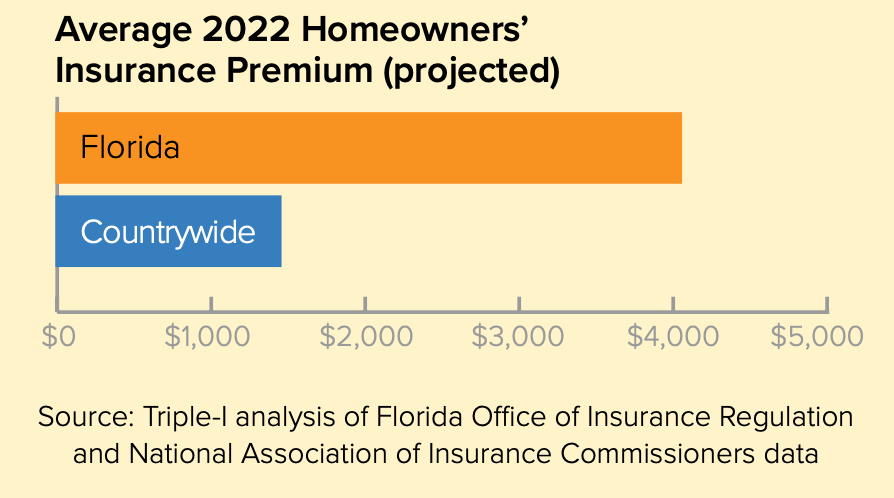

Let’s start with this first image. Florida residents pay some of the highest insurance premiums in the country clocking in at $4,231 per year on average. This three times higher than the national average.

And here’s the thing. Last year Florida real estate homeowners insurance rates increased by 33% versus 9% for the rest of the country.

That’s because of the issues with fraudulent claims and the increased activity and intensity of hurricanes.

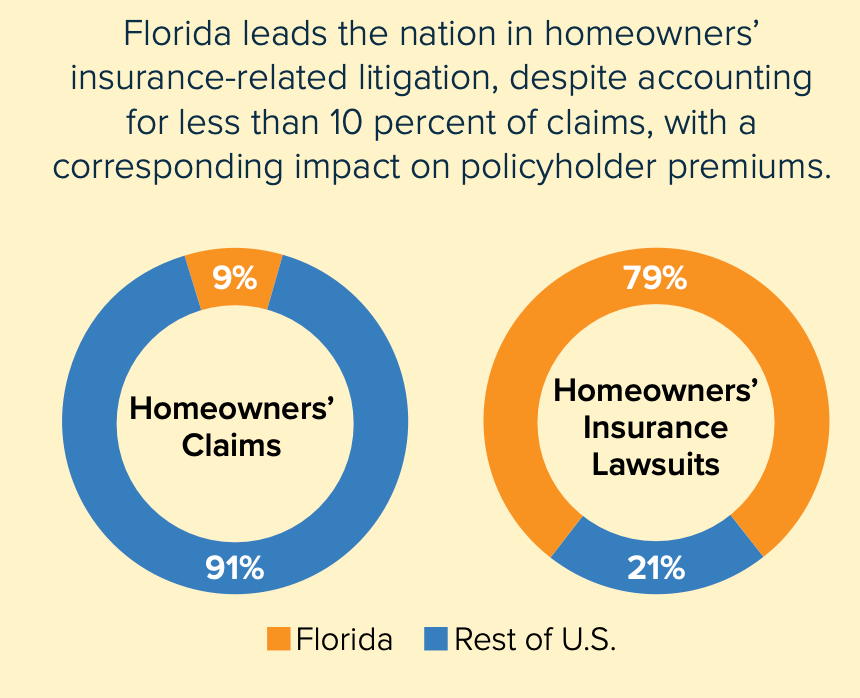

Look at this chart:

In October, the Insurance Information Institute published data showing that Florida real estate leads the nation in homeowners insurance related litigation making up 79% of the lawsuits across the United States while accounting for just 9% of the total claims.

That is a nightmare.

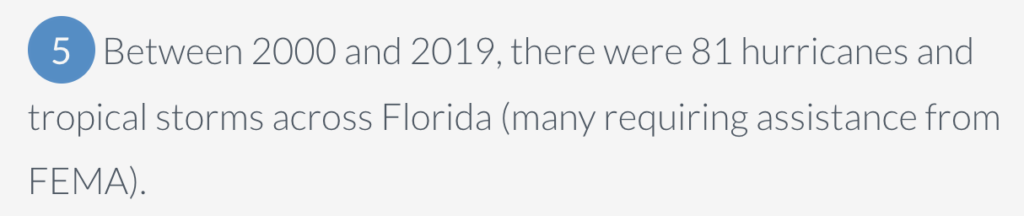

And then there’s this. Between 2000 and 2019, there were 81 hurricanes and tropical storms that crossed Florida. Those caused assistance from FEMA. Between 2017 and 2021 there were $51 billion in insurance claims paid out by the insurance companies.

71% of $51 billion was paid out to attorneys, insurance adjusters, and only 8% of that money went to the claimants. So someone reports an insurance claim and only 8% goes to the claimants, but the rest of it is going to other third parties?

This is not good.

United Property and Casualty is a company that’s currently in liquidation. They wrote from 1851 to 2018, about a 170-year period, 292 hurricanes hit the United States. 41% of those hit Florida, and about 120 of those were a Category III or greater.

Why Florida Real Estate Insurers Are Bailing Out

Based on that, how are the insurance companies doing? Take a look at this:

You can see domestic property insurance companies since 2017. They lost over $300 million through 2019. Then in 2020, they lost over $1.35 billion. And in 2021, the same about $1.18 billion.

Over the last half dozen years, there’s been about 11 insurers who’ve said that’s it. They’re leaving the state. Companies like AAA, Bankers, Farmers… the list goes on. So, with these insurance companies leaving, what happens to those policies that exist?

Well, that’s where the state-run Citizens Property Casualty Insurance Corporation comes in. They don’t want to be in the business of handling policies or claims, but they were set up to handle policies and claims when private insurers leave.

Take a look at this:

You can see since 2017, they went from having about 400,000 policies and now its ballooned to 1 million last year. This year, the number’s near 1.3 million. They’re saying by the end of 2023, it could be about 1.5 million policies.

Florida Real Estate Insurance Is Turning Around

But there’s good news on the horizon.

Florida enacted new legislation to help fight against fraudulent claims.

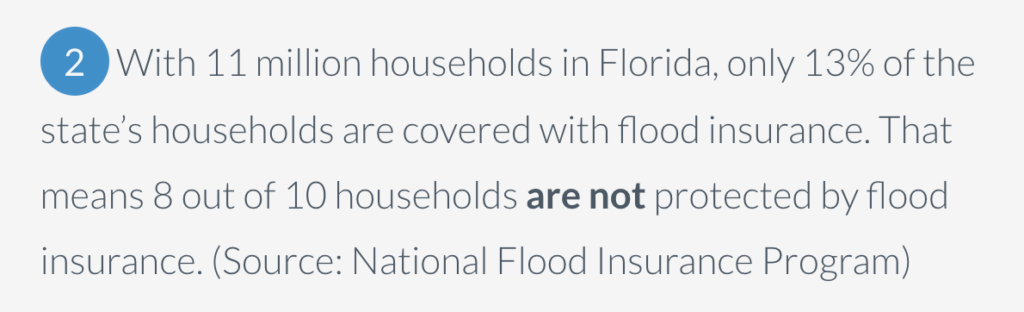

For now, take a look at this on flood insurance:

With 11 million Florida real estate households, only 13% of them are covered with flood insurance. That means about 8.5% out of 10 are not protected by flood insurance. Here’s the thing, if you’re thinking about moving to Florida, the highest elevation is just a few hundred feet? So, most of us are in some area of flood.

Your home may not be in a designated flood zone, and if you’re on the fifth floor of a condominium, it doesn’t apply. But, be informed: flood insurance does not come with homeowners insurance policies.

Those are two separate things. And, relatively speaking, flood insurance is not expensive. So if you are buying a home in a low lying flat area in the state of Florida, which is most of us, you should take a look at getting flood insurance coverage.

Now you have a perspective of the issues facing homeowner’s insurance in Florida. With that, the big question is this, “why will the insurance debacle not derail Florida real estate moving forward?

Well, here’s the thing. Since 1992, there’s been hurricane Andrew, William, Charlie, Ivan, Irma… there’s been a lot of hurricanes come through the state and Florida recovered each time. They’ve help pay all claims, rebuild cities, rebuild communities, and more.

The state of Florida is doing everything they can to write new legislation to help insurance companies return to the state. Over the last 90 days, they’ve approved three new homeowners insurance companies and two new flood insurance companies to start writing policies in Florida.

Over the coming years, these numbers going to grow. Why?

Because net migration to the state of Florida is still averaging over 350,000 people each year. Insurance companies see this as a massive market and want to capitalize on this trend.

This is why Florida real estate will continue to thrive and not be hurt by the insurance issues.

Florida real estate market continues to be the hottest in all the United States, and it’s going to be like that for the rest of this decade. At same time, the worst is now behind us for the insurance industry, and inflation. The state has put in new legislation and laws to help the frivolous, fraudulent part of the insurance industry.

A handful of new carriers are now writing policies in the state. This should in crease competition and begin driving prices down.

Things are looking better for the state of the Florida real estate market. It’ll just take a bit of time for all this to help consumers pocketbooks… so stick around.

——————————————————

Florida Real Estate will NOT be Killed By The Insurance Debacle! Yes, the insurance situation has been mess in Florida. But Florida real estate is resilient and the worst may now be behind us…

Grab my FREE Delray Beach (and surrounding areas) Relocation Guide – https://mrdowntowndelray.com/relocation-guide-delray-beach/

Sign Up to my Weekly eLetter: https://mrdowntowndelray.com/weekly-eletter-2/

WELCOME TO MY CHANNEL! If you’re new, please subscribe: 👇👇👇👇👇👇👇👇👇👇 ✅ https://bit.ly/33u34fZ

Ready to start the conversation about moving to Delray Beach Florida? Call/Text me at 561-777-4089. If you’re thinking of moving or relocating to Delray Beach or South Florida, I can help you.

🙋♂️Let’s be social: * Instagram: https://www.instagram.com/johnmwieland/?hl=en * Facebook: https://www.facebook.com/RealtorProJo… * Twitter: https://twitter.com/JohnMWieland * LinkedIn: https://www.linkedin.com/in/john-m-wi…

🧑💻 Home Search: https://mrdowntowndelray.com/

Realtors – Partner with me at EXP Realty! Schedule a call to learn how. Florida license SL3444240. (I lived in Costa Rica for over 12 years. Owned & operated 13 real estate franchise offices. If you’ve ever thought about buying a home in Costa Rica, call me. I can help you get from here to there safely and guide you through the entire process. My Costa Rica Rolodex is full of friends, lawyers, tour operator to help ).