No matter where you lived over the last 12 months, you thought the Florida real estate market was going to crash. But guess what? It’s behind us. Here’s why…

You see, you were probably spending a lot of time looking at headlines about the pending recession, and about the Florida real estate market about to crash. Or, how news outlets were trying to compare this real estate market to the debacle of 2008. But those are apples and oranges.

So, to understand where the Florida real estate market is heading, you need to understand two words, supply and demand.

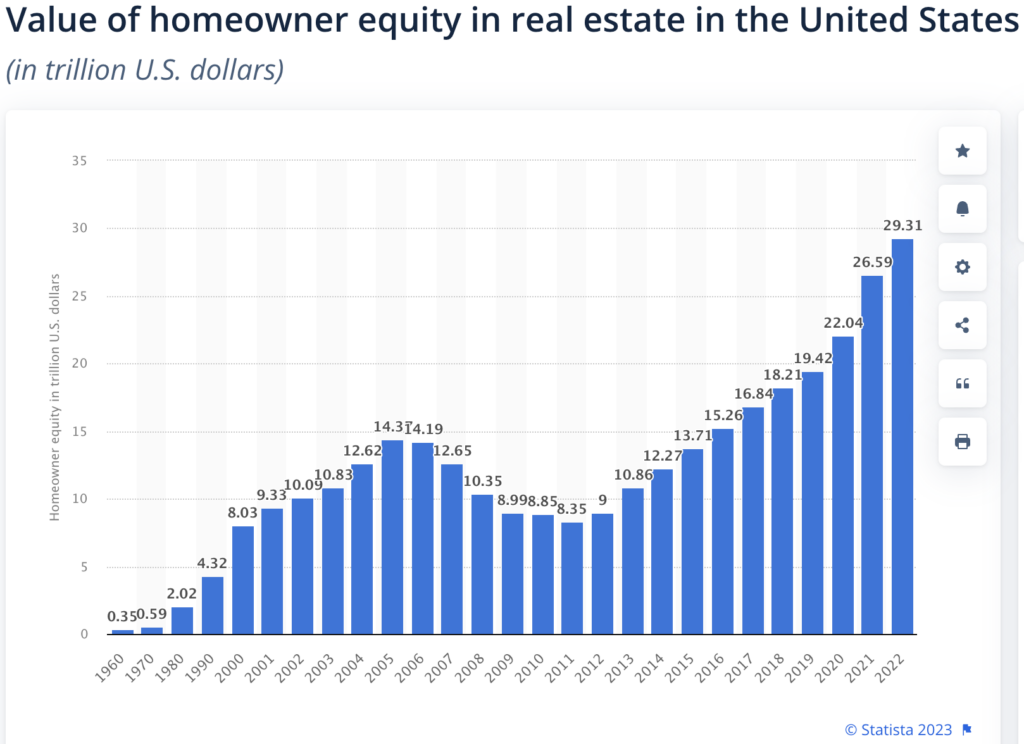

Here’s a start and a data dump of how the real estate market strength is about equity and what’s going on with home ownership. Look at this first chart.

It shows the home equity in the United States. Today is over $29 trillion. If you look back to 2008, that’s about triple the amount. That is pent-up demand.

Then the 39% of homeowners who own their property free and clear. They don’t have any mortgage. What does that mean? Well, the headlines for the last two or three years has been there’s more and more cash buyers coming from the Northeast states. They’re moving to places like Florida.

California money is taking their equity and moving it to the Texas and Florida real estate markets. Their money is going further, and they don’t need to get mortgages. So, a high percentage of home ownership today is free and clear of mortgages.

It’s More Than Just The Florida Real Estate Market

Job growth is strong. The economy is good. There’s a lot of pent-up equity in the market. On top of that, 29% of homeowners today own 50% or more equity in their homes. Why?

On average, home ownership lasts between 7-9 years. Because of the pandemic, people had to stay in their homes longer.

The average home ownership now is between 9-12 years. That shows one thing. Over the last 12 years, Florida real estate prices have done one thing – go up. That gives people a cushion and lot more equity.

As for Days On Market (DOM) July, 2022, was the zenith of the market. It took 14 days on average to sell a home in the us. Over the next 6 months, it more than tripled to 54 days. Since January 2023, it’s down by 50%.

The next thing is the 3 million households in the United States who have salaries more than $150,000 per year who are… renting. That is massive amount of demand sitting there waiting for things to change.

To continue, the United States is short by about 4 million homes. Again, a lot of pent-up demand with a lot of cash behind it

It gets even better. Right now, mortgage rates are hovering near 7%. And experts believe inflation is now tamed. That it’s under control and it will continue falling.

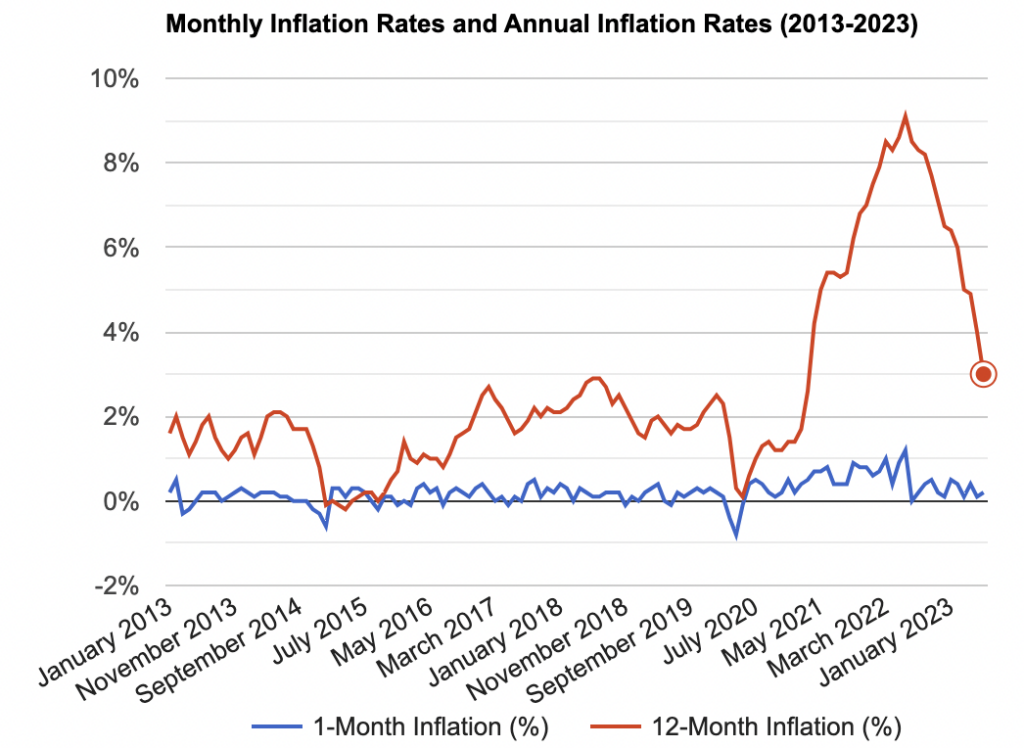

Let’s look at this chart.

This is the seasonality effect chart. Inflation was low then went up to 9.1%… and now it’s down into the 4% range. All the fear of inflation in 2022 is now almost behind us. And they’re saying that there’s a lag effect in interest rates.

Interest rates are not correlated to inflation, but for the last few years, they’ve followed each other. If inflation falls, we may see mortgage rates go from 7% to 6% or even lower.

If that happens, this Florida real estate market is off to the races.

Let’s pivot from the national news to more of the Florida real estate market and South Florida. 2011 was the bottom. That’s when you could buy real estate for about 30-35 cents on the dollar. Today, it’s more like $1.30. You’ve lost your buying power. You may be thinking prices must start falling soon. (they did the last 12 months, but I believe that’s all over now).

People are still migrating from places like New York, New Jersey, Connecticut, Massachusetts. They’re leaving high state income tax, and moving to Florida. They’re getting away from the cold, they’re moving south. They say that the business environment is a little bit stronger in Florida.

Same with California. I’m dealing with over six customers right now who are in the process over the next six months who are relocating or just leaving California. Why? Because they can get a lot more for their money here in real estate and leave high taxes. A lot of entrepreneurs are throttle down with taxes in the state of California.

Next is supply. Four years ago there was over 54,000 properties for sale in South Florida. Then it dropped over 72% to 14,485. In 2022, it rose by over 100%. Since January 2023, inventory is down 22 of the last 24 weeks. Inventory in down.

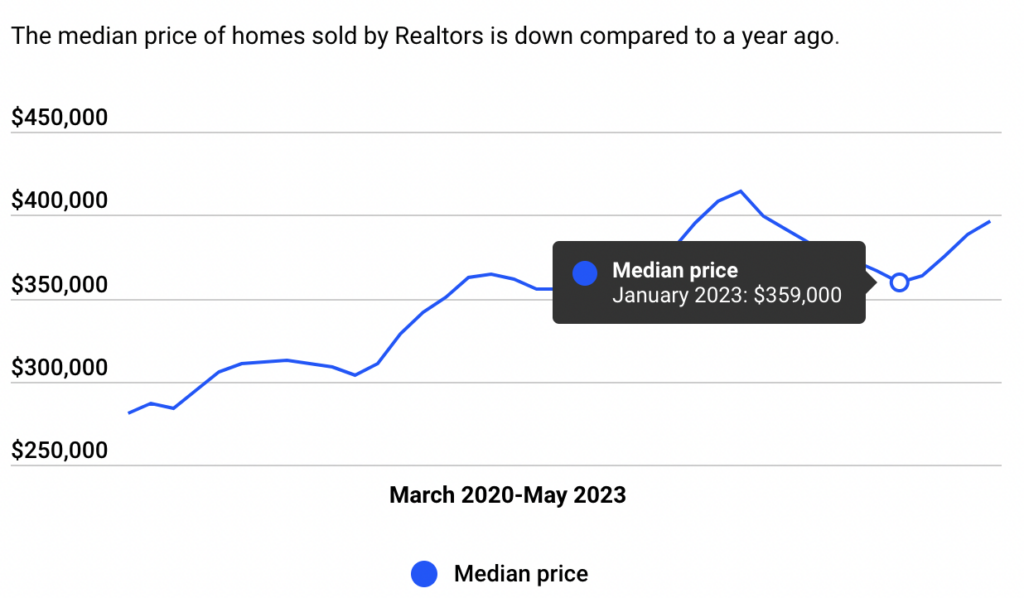

Look at this chart. I call it “the U effect.’ That’s when prices were high, fell, and came back.

The median list price of a home in South Florida a year ago, was $470,000. Then prices fell 25% to $350,000. Prices are back up to $420,000. So, you can see there was a lot of fear when prices were coming down and people weren’t acting on that. Now the correction is over. Prices started to go up because demand is high, and supply is way down.

What does all this mean nationally and in the South Florida real estate market? It’s simple.

Real estate needs to be broken down into supply and demand. Too many folks spend a lot of time looking at headlines like the commercial real estate debacle. In San Francisco they’re vacancy is between 30 – 50%. Prices are crashing. Places like Boston are getting headlines with similar stories.

But those are apples. Residential real estate is oranges. We need to focus on supply and demand in this market. Demand is up, pent up. Equity around the country is up. People have more money sitting there.

Job creation is strong. There’s a lot of demand with a strong economy.

At the same time, sellers don’t want to sell. So, inventory is down. Florida real estate prices are going up. I don’t see with all this evidence of any chance of a real estate market crash in the future.

But I’ve been through real estate ups and downs since the late 80’s and the saving and loan debacle. Something may sideswipe us that we can’t see now. That’d be one way to turn the market negative. But unless that happens, this real estate market is continuing is upward march.

Florida Real Estate News – There is NO Market Crash

Mainstream media headlines show real estate crashing. But real estate experts say the opposite. And when you’re thinking of Florida real estate… the data proves how sustainable the current strength is. So look at the data as I have – there is no market crash coming to the Florida real estate market.

WELCOME TO MY CHANNEL! If you’re new, please subscribe: 👇👇👇👇👇👇👇👇👇👇 ✅ https://bit.ly/33u34fZ

Ready to start the conversation about moving to Delray Beach Florida? Call/Text me at 561-777-4089. So if you’re thinking of moving or relocating to Delray Beach or South Florida, I can help you.

Grab my FREE Delray Beach (and surrounding areas) Relocation Guide – https://mrdowntowndelray.com/relocation-guide-delray-beach/

Get your free weekly eLetter: https://mrdowntowndelray.com/weekly-eletter-2/

🙋♂️Let’s be social: * Instagram: https://www.instagram.com/johnmwieland/?hl=en * Facebook: https://www.facebook.com/RealtorProJo… * Twitter: https://twitter.com/JohnMWieland * LinkedIn: https://www.linkedin.com/in/john-m-wi…

🧑💻 Home Search: https://mrdowntowndelray.com/ Realtors – Partner with me at EXP Realty! Schedule a call to learn how. Florida license SL3444240.

(Oh yeah, I lived in Costa Rica for over 12 years. Owned & operated 13 real estate franchise offices. If you’ve ever thought about buying a home in Costa Rica, call me. I can help you get from here to there safely and guide you through the entire process. My Costa Rica Rolodex is full of friends, lawyers, tour operator to help ).

#delraybeachrealestate #delraybeachrealtor #johnwieland